Test Owner

Great to be back at Airline Economics Growth Frontiers in Dublin this week and to catch up with so many across the aviation finance and aircraft leasing community.

With OEM delays, limited supply, and increasing market complexity, it is clear that talent and access to capital remain the key differentiators.

Having recruited in aviation finance for two decades, GKR Search and Selection seen the talent landscape change significantly. In the early years, we often had to explain what aircraft leasing was. Today, it is a recognised and highly attractive target sector for people who want a long-term career in the industry.

The sector itself has also grown considerably. There are more platforms, more capital sources and more specialist roles than ever before, and the talent pool has expanded with it. The strongest organisations now have real depth across commercial, credit, technical, legal, restructuring, asset management and capital markets.

We also continue to hear consistent feedback from the market. People want to work for the right platform, one with a strong track record, a positive culture, and leadership teams that are genuinely diverse. Those factors increasingly shape where people choose to build their careers.

It was also great to attend the PropelHer event during the week. The event was packed and full of energy, and it is clear the organisation is building real momentum and strengthening the pipeline of future leaders across aviation finance.

AviationFinanceAircraftLeasingAirlineEconomicsDublinLeadershipPropelHerGKR

Western insurers have lost the right to appeal a major London High Court judgment that could see aircraft lessors recover more than US$1 billion from war-risk insurance policies for jets stranded in Russia after the 2022 invasion of Ukraine.

The High Court’s refusal to permit insurers to appeal the decision marks a significant development in one of the largest legal battles in aviation insurance history. Judge Christopher Butcher denied permission on all grounds, although decisions on legal costs will be determined at a later date.

Originally, lessors including AerCap (Ireland-based), Dubai Aerospace Enterprise (DAE), Merx Aviation, KDAC Aviation Finance, Falcon and Genesis brought claims against a group of global insurers, such as AIG, Lloyd’s, Chubb, Swiss Re and HDI Global Specialty, seeking compensation for almost 150 aircraft and some engines that remain in Russia due to export bans and sanctions.

In June, the court held that the affected aircraft met the legal definition of “lost” under the applicable war-risk insurance policies, allowing lessors to recover significant sums, although attempts to claim under broader “all-risks” coverage were rejected.

The case has become a bellwether for similar litigation globally, with related claims progressing in other jurisdictions, including the United States.

Read more here.

Global airlines incurred more than US $11 billion in additional costs over 2025 as ongoing aerospace supply chain disruptions continue to weigh on the industry, according to a new report from the International Air Transport Association (IATA).

The analysis, which is the first to put a firm financial figure on the impact of prolonged supply chain constraints, points to persistent labour shortages, material availability issues and delays in aircraft parts and engine repairs. These challenges are forcing airlines to operate older and less fuel-efficient aircraft for longer, while also driving higher maintenance, leasing and inventory costs.

IATA identified several factors contributing to the increased financial burden on carriers. These include higher fuel consumption linked to ageing fleets, rising maintenance expenses as aircraft remain in service beyond planned replacement timelines, and escalating engine leasing costs as repair backlogs continue to grow. Airlines are also carrying larger inventories of spare parts in an effort to protect operations from further disruption, adding to overall costs.

IATA Director General Willie Walsh described the situation as “a massive drag on the industry,” warning that supply chain constraints are likely to remain a structural challenge for airlines well into the latter part of the decade.

The findings come at a time of strong and sustained demand for air travel, with passenger numbers continuing to rise. However, aircraft manufacturers and the wider aerospace supply chain are struggling to match that demand, placing increasing pressure on airline operating costs and profit margins across the sector.

Read more here.

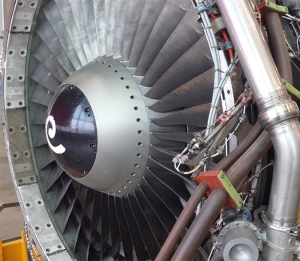

2026: Engine Shortages and Grounded Aircraft Are Now the Primary Constraint on Global Fleet Availability

Engine availability has emerged as the most immediate operational constraint shaping the aircraft leasing market, overtaking airframe production delays as the dominant short-term risk for airlines. Ongoing shortages of spare engines, extended shop visit timelines, and constrained MRO capacity are grounding aircraft across multiple fleet types, particularly next-generation narrowbodies.

Airlines operating GTF-powered fleets and older CFM variants are facing longer-than-expected maintenance cycles, with limited access to replacement engines exacerbating downtime. As a result, carriers are increasingly turning to lessors for short-term lift, lease extensions, and stop-gap capacity to protect schedules and maintain network integrity.

For lessors, the engine situation is reinforcing demand for available aircraft with clear maintenance status and near-term operability. Mid-life assets with strong maintenance records are benefiting, as airlines prioritise certainty of availability over fleet modernisation timelines. Lease extensions are becoming more common as operators delay returns and seek stability through the disruption.

The engine bottleneck is expected to persist through the mid-to-late 2020s, supporting utilisation rates, sustaining lease pricing, and increasing the strategic value of technical asset management within leasing portfolios.

Read more here.

Aircraft Leasing Sector For 2026 Remains Supported by Strong Travel Demand and Supply Constraints

Industry outlook reports for 2026 continue to point to a stable outlook for the aircraft leasing sector, underpinned by sustained airline demand and ongoing production constraints at major OEMs. With global travel demand remaining resilient, airlines are prioritising capacity retention and fleet continuity, reinforcing the strategic importance of leased aircraft.

At the same time, persistent delivery delays and supply chain bottlenecks are limiting new aircraft availability. This imbalance is maintaining upward pressure on lease rates and supporting asset values, particularly for in-demand narrowbody and mid-life aircraft. Lessors with available inventory are therefore well-positioned to benefit from current market conditions.

For airlines, the environment reinforces a shift towards flexible fleet planning and closer engagement with leasing partners. For lessors and aviation finance teams, the outlook points to continued activity across portfolio management, asset trading, technical oversight, and commercial origination as the market moves into 2025.

Read the full industry outlook via The World of Aviation

Lessors Expected to Strengthen Position Over 2026 with Fuel-Efficient Fleets amid OEM Backlogs

Aircraft lessors are expected to further strengthen their market position over 2026 as airlines respond to sustained OEM delivery backlogs by prioritising access to modern, fuel-efficient aircraft. Market analysis points to continued growth in leasing demand as carriers balance capacity needs with cost control and sustainability pressures.

With production delays limiting direct fleet expansion, airlines are increasingly relying on lessors to provide near-term lift, particularly through new-generation narrowbody aircraft and structured wet lease solutions. This shift is reinforcing the role of leasing as a core fleet strategy rather than a short-term bridge.

For lessors, the focus on fuel efficiency is supporting asset values and driving competition for high-spec aircraft, while also increasing operational complexity across technical management, contract structuring, and fleet placement. Wet leasing remains an active segment as airlines protect schedules and manage seasonal demand volatility.

Read the full market analysis via GlobeNewswire

Roxana Duta

Roxana has over 18 years of recruitment experience, predominantly within the aviation industry, Roxana has developed extensive expertise in sourcing and placing high-calibre talent across global markets. Her career has been defined by a strong track record of success in both technical and executive leadership appointments, supporting organisations in building high-performing teams at every level. Roxana graduated with a degree in Public Administration.

Karinda Tolland

Karinda has more than 10 years’ experience in recruitment with a focus on senior roles in corporate finance, investment banking, and asset finance. She previously worked in financial services across several jurisdictions including ABN Amro and Credit Suisse First Boston in Sydney, and Salomon Smith Barney in London. Karinda holds a BA in Anthropology from Maynooth University and has recently completed a Ph.D. with Dublin City University.

Tara McMahon

Tara is a Recruitment Consultant with GKR and comes with a wealth of experience from her previous positions; specifically, from ten years working as the Tourism and Marketing Manager for Inishbofin Island, Co. Galway.

Tara has excellent experience in administration, event management and marketing. She has meticulous organisational skills and an enviable attention to detail. She also has an excellent academic record, holding a BA Hons in English and History and an MA in History of Art and Architecture from the University of Limerick.

Shane Kearney

Shane brings over 28 years’ experience in the Aviation industry to the GKR team. He began his career in the Irish Air Corps and is currently a Captain with Aer Lingus on the Airbus A330 operating from Dublin to destinations in the United States and Europe. He has a deep understanding of the industry and has wide experience, which is relevant to Aircraft leasing recruitment. He has been involved in Airbus aircraft deliveries in Hamburg/Toulouse, technical flights and return to lessor projects and with these experiences, adds a unique technical perspective to our Recruitment team.